Christian Stracke Net Worth in 2026: Estimated Value and Wealth Breakdown

Christian Stracke net worth draws curiosity for one simple reason: he’s a real finance executive, not a typical celebrity with a public paycheck. That means his wealth is mostly private, tied to compensation structures and investments that don’t get published like movie salaries. Still, you can build a grounded picture by looking at what he does professionally and the types of income streams that usually come with that level of global investment leadership.

Who Is Christian Stracke?

Christian Stracke is a senior investment executive at PIMCO (Pacific Investment Management Company), a major global investment firm best known for fixed income and multi-asset strategies. He has held top leadership responsibilities, including executive oversight outside the Americas and senior involvement in portfolio and strategy work across private and alternative credit areas.

Outside finance, he’s widely known in pop culture as the ex-husband of Sutton Stracke from The Real Housewives of Beverly Hills. But his net worth story is fundamentally a finance story: long-term senior roles, performance-linked pay structures, and investing that can compound quietly over decades.

Estimated Net Worth

Christian Stracke’s net worth in 2026 is most commonly estimated in the $30 million to $50 million range. These figures are not audited or officially disclosed. They’re best understood as an informed bracket based on his seniority in investment management and the typical compensation patterns for executives at major firms.

With private-sector finance careers, it’s normal for estimates to vary. Unlike actors or athletes, executives rarely have public contract values. And because compensation in this world is often bonus-heavy and investment-driven, two people with the same title can build very different fortunes depending on tenure, deal structure, and how aggressively they invest and retain earnings.

Net Worth Breakdown

1) Executive compensation at PIMCO

The core driver of Stracke’s wealth is almost certainly his compensation as a top executive at a global investment firm. At this level, pay typically includes a strong base salary plus substantial annual bonuses and long-term incentives. Those incentives are designed to reward performance and retention, and they’re often where real wealth is built.

In other words, the number that matters most usually isn’t the salary. It’s the total compensation package over many years, especially when bonuses are large and repeated.

2) Performance-linked bonuses and incentive pay

Senior investment leadership often comes with performance-linked compensation. While exact structures vary, the general pattern is that results and responsibility drive bonuses. In high-level roles, those bonuses can be significant enough to change net worth outcomes quickly over time.

This is one reason net worth estimates for senior finance professionals can look large even without public salary disclosures. If you earn sizable bonuses for years and invest them consistently, wealth can compound into the tens of millions.

3) Long-term investing and compounding

Another likely pillar is straightforward compounding. A long-tenured finance executive typically invests methodically across diversified assets and lets time do the heavy lifting. When high income meets long time horizons, the compounding effect becomes powerful.

This matters because net worth at the $30–$50 million level is rarely a “one big payday” story. It’s usually an “every year, for many years” story: high earnings, disciplined investing, and retained wealth that grows steadily.

4) Private assets and real estate

Real estate is also commonly part of the wealth picture for high earners. Property can store value, provide lifestyle stability, and potentially appreciate over time. Many senior executives also use real estate as a practical wealth-preservation tool, especially when their careers involve international work and long-term planning.

The public does not have a complete inventory of Stracke’s personal assets, so this category is best viewed as a typical component rather than a confirmed set of holdings. But as a general net worth driver, it’s one of the most common pieces for people earning at this level.

5) Divorce-related obligations and what they suggest

His finances are frequently discussed because of widely circulated reporting about divorce-related support arrangements connected to Sutton Stracke. While those reports do not confirm an exact net worth, they are often cited as evidence of substantial earning capacity and resources, since large ongoing payments generally require a high and stable financial base.

From a net worth perspective, the key point is that recurring obligations can affect how quickly wealth compounds. Even with strong income, large long-term payments can reduce retained cash flow, which can influence the pace of net worth growth over time.

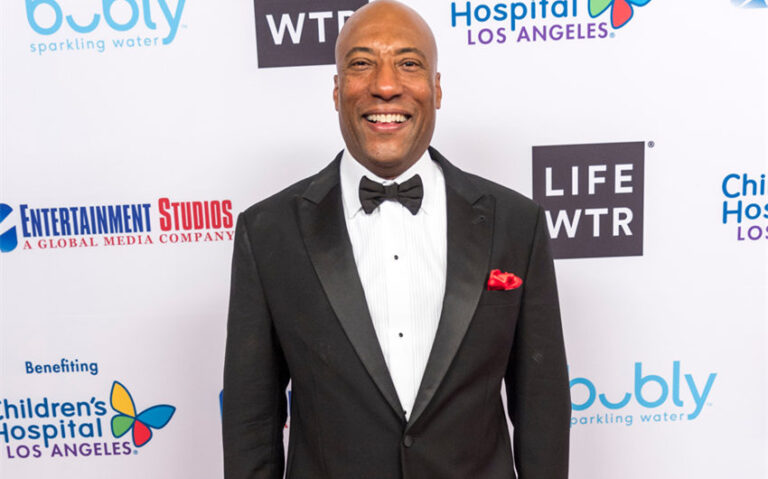

Featured Image Source: https://www.pimco.com/gb/en/experts/christian-stracke