Candace Owens’ Husband Net Worth: George Farmer’s Estimated Wealth and Income Breakdown

Candace Owens husband net worth is a common search because George Farmer lives at the intersection of money, politics, and privacy. He’s not a celebrity with public salary reports, and he isn’t a public-company CEO with filings that spell everything out. So the figures you see online are estimates—sometimes reasonable, sometimes exaggerated. Still, you can understand what likely drives his wealth by looking at his background, leadership roles, and the kinds of assets people in his world typically hold.

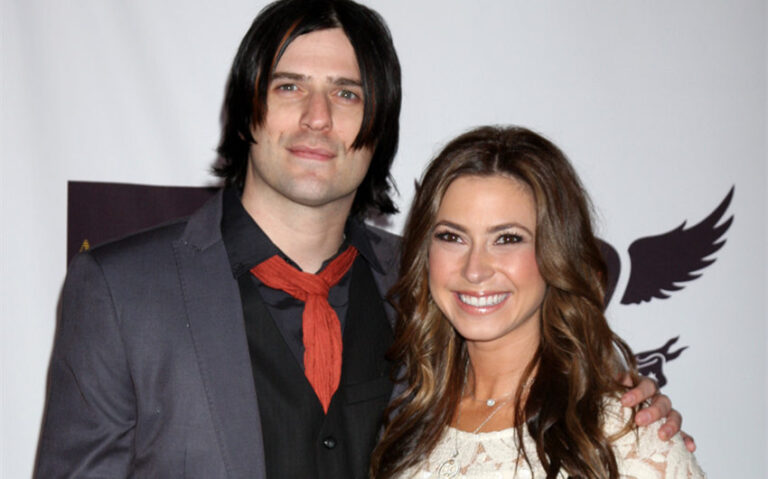

Who Is Candace Owens’ Husband?

Candace Owens is married to George Farmer, a British businessman who has held leadership roles in conservative-leaning organizations and tech-related ventures. He became especially well-known in the U.S. because of his public connection to Parler, a social platform that positioned itself as a free-speech alternative during a period of intense political and platform moderation debates.

Farmer’s profile is also shaped by family background. He is the son of Lord Michael Farmer, a British businessman and member of the House of Lords. That detail matters for net worth discussions because family wealth can change a person’s financial starting line dramatically, even before you factor in personal career earnings.

In short, George Farmer is best understood as a private businessman with visible political-tech chapters, not as a public entertainer whose income can be measured through contracts and box office numbers.

Estimated Net Worth

George Farmer’s net worth is not publicly verified as a single confirmed number. Most online estimates fall into a very wide band, with some frequently repeated figures clustering in the $100 million to $200 million range. You’ll also see specific numbers like $180 million cited, but those should be treated as commonly repeated estimates, not audited facts.

The safest way to interpret the situation is this: Farmer is widely described as very wealthy, likely at least an eight-figure individual, and possibly higher depending on how much family wealth, private business equity, and investments are attributed to him. Because so much of the underlying financial information is private, the best practice is to use a range and focus on the breakdown drivers rather than pretending the estimate is exact.

Net Worth Breakdown

1) Family wealth and inherited advantage

For many people, wealth starts with earnings. For people from extremely wealthy families, wealth often starts with access. If you grow up inside a high-net-worth environment, you may benefit from early capital, early investing, elite networks, and deal flow that isn’t available to the average person.

That doesn’t automatically mean George Farmer’s wealth is “all inherited,” but it does suggest a powerful head start. A head start matters because it changes compounding. Investing earlier—and at larger scale—can create a much larger long-term outcome even if your personal career earnings are similar to someone else’s on paper.

This is one reason some net worth estimates go so high. Writers often assume that a wealthy family background equals massive personal wealth. The reality is more nuanced: family wealth may be partly shared, partly structured, and partly held in ways that don’t cleanly translate into a personal net worth number.

2) Executive roles and compensation structures

Farmer’s public career includes leadership roles that can be lucrative, especially when they involve senior executive responsibilities. Executive compensation typically includes more than a base salary. Depending on the organization, it can include bonuses, incentives, and—most importantly—equity or equity-like participation.

Equity is where net worth estimates can swing wildly. A salary can be guessed within a general range. Equity is harder, because it depends on private company valuations, ownership percentages, vesting terms, and whether the equity ever becomes liquid. Two people can hold the same title and have completely different wealth outcomes depending on how their equity was structured.

Because many of Farmer’s roles have been tied to private organizations and politically adjacent tech ventures, there is limited public transparency on exact compensation. That doesn’t mean he didn’t earn well. It means outsiders can’t responsibly convert job history into a precise net worth figure.

3) Parler: visibility doesn’t equal a payday

Parler is the chapter that most people recognize, which is why it often dominates net worth conversations. But here’s the key distinction: a high-visibility role doesn’t automatically mean a massive personal gain. A CEO can be paid well, yet still not receive meaningful equity. Or a CEO might receive equity that never becomes valuable in the way the public imagines.

Parler’s story also included turbulence, platform removals, ownership changes, layoffs, and ultimately a shutdown phase. That kind of volatility makes it even harder to connect “CEO of Parler” to “added $X million to net worth.” The platform brought attention, but the financial impact depends entirely on private deal terms the public cannot confirm.

So it’s more accurate to say Parler likely increased Farmer’s visibility and network leverage than to claim it guaranteed a specific wealth jump.

4) Investment portfolio and private holdings

High-net-worth individuals rarely rely on one income stream. Most build wealth through a portfolio: diversified investments, private equity stakes, long-term funds, and real estate. If Farmer’s background includes family-driven investing culture and access, it’s reasonable to assume that his wealth—whatever the true number is—likely includes multiple asset categories rather than being tied to one job.

This is also why net worth estimates differ so much online. Private assets are hard to value from the outside. One writer assumes aggressive valuations and calls him worth $200 million. Another assumes conservative valuations and calls him worth $20 million. Without transparent disclosures, both are guesses. The only defensible approach is to acknowledge the private-asset factor and use a wide range.

5) Real estate and lifestyle assets

Real estate often plays a major role in the wealth profiles of people with international backgrounds and high incomes. Property can store value, provide stability, and appreciate over time. It can also be held through structures that make public valuations difficult. Even when real estate isn’t the largest slice of a portfolio, it often contributes meaningfully to net worth calculations, especially over many years.

Because Farmer’s personal holdings aren’t publicly itemized, you can’t confirm specific properties or values here. But in a realistic “how does someone like this build wealth?” breakdown, real estate is a common pillar.