Carter Reum Net Worth Estimate, Who He Is, and Wealth Breakdown Explained

Carter Reum net worth is a common search because he keeps a relatively low public profile while operating in high-stakes venture investing—and because he’s married to Paris Hilton. The short answer: there isn’t a single “official” number, but credible public estimates commonly land in the tens of millions, with uncertainty driven by private-company stakes and venture fund economics.

Who Is Carter Reum?

Carter Milliken Reum is an American entrepreneur, author, and investor best known for co-founding the venture capital firm M13 and for previously co-founding the spirits brand VEEV. He also spent time earlier in his career as an investment banker at Goldman Sachs.

Today, he’s most closely associated with M13, which invests in early-stage consumer and technology companies. Recent business coverage has described M13 as managing roughly $1.3 billion in assets under management (AUM), which signals scale—but doesn’t translate 1:1 into personal net worth.

Estimated Carter Reum Net Worth

Because much of Reum’s financial upside is tied to private investments, fund carry, and illiquid equity stakes, estimates vary. A widely cited public estimate places his net worth at about $20 million.

It’s also common to see estimates presented as a range (roughly $20 million to $40 million), largely because outsiders can’t precisely value private holdings, carried interest, and the timing of venture exits.

Net Worth Breakdown: Where the Money Likely Comes From

M13: Equity Stakes, Management Fees, and “Carry” (The Big Variable)

M13 is the centerpiece of Reum’s financial story. The firm’s scale is often discussed in terms of AUM—reported around $1.3 billion in some coverage.

Here’s why that matters, and why it still doesn’t give you a clean net worth number:

Management fees are typically paid to the firm to run its funds. That creates business revenue, but it doesn’t automatically equal personal wealth because those fees pay salaries, overhead, research, operating costs, and reinvestment into the firm.

Carried interest (“carry”) is where venture partners can make substantial money. In simple terms, carry is a share of the profits a fund generates after investors get their money back. However, carry depends on exits (acquisitions or IPOs), fund terms, and how long it takes portfolio companies to mature. It can look massive on paper during high-valuation periods and then shrink if markets cool.

Ownership in the management company can also be valuable. If a partner owns a meaningful percentage of the firm that collects fees and earns carry, that equity can add to long-term net worth. But those ownership structures are private, and the value is typically not something the public can accurately calculate.

The headline takeaway is simple: M13’s success can support a high net worth, but the exact figure swings with market cycles and exit timing.

VEEV Spirits: A Founder Exit That Likely Created Early Wealth

Before M13, Reum co-founded VEEV, a spirits brand. Luxco announced an agreement to acquire VEEV in 2016, and the announcement noted that deal terms were not disclosed. That lack of disclosure is one of the biggest reasons you see varying net worth estimates—outsiders can’t back into a clear payout number.

Even without a published sale price, an acquisition like this commonly creates wealth for founders in one or more ways:

Liquidity at closing if part of the purchase price is paid in cash, performance-based earn-outs if additional payments depend on the brand’s results after the sale, or continued equity exposure if the founders retain some interest through the transaction structure. Any of these outcomes can form the base of a later investing career.

Book, Media, and Speaking Income: Helpful Cash Flow, Usually Not the Core

Reum has also been active as an author and public-facing business personality. Income from books, speaking, and media appearances can add steady cash flow and strengthen a personal brand. Still, for someone most known for venture investing, these streams are typically secondary compared to the upside of equity stakes and fund performance.

In practical terms, this category tends to function as a stabilizer: it diversifies earnings, supports long-term investing, and increases visibility with founders and business partners.

Personal Investing Outside the Fund: Quiet Stakes That Can Matter

Many venture investors also invest outside their main funds through personal angel checks or special-purpose investments. This is another reason estimates vary. Even if you know a list of companies someone has backed, you typically don’t know the ownership percentage, the entry valuation, whether the stake was diluted, or whether there’s any liquidity yet.

When people say venture wealth is “lumpy,” this is what they mean. A portfolio can sit dormant for years, then a single exit can change the net worth conversation overnight.

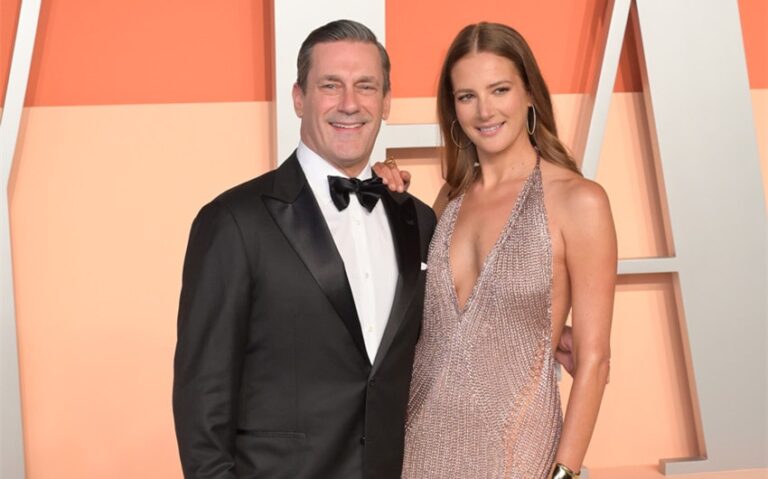

Marriage to Paris Hilton: Visibility Boost, Not a Simple Math Problem

Reum’s marriage to Paris Hilton increased the public’s curiosity about his finances, but it’s not accurate to assume two public net worth figures simply combine into one shared total. High-net-worth individuals frequently hold assets through business entities, trusts, and long-term structures, and private arrangements can affect how assets are managed.

The straightforward way to view it is this: his personal net worth estimates are primarily tied to his entrepreneurship and venture investing, while his marriage largely explains why the topic draws so much attention.